owner draw vs retained earnings

Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering. Dividends are paid out of the profits and reserves of a company.

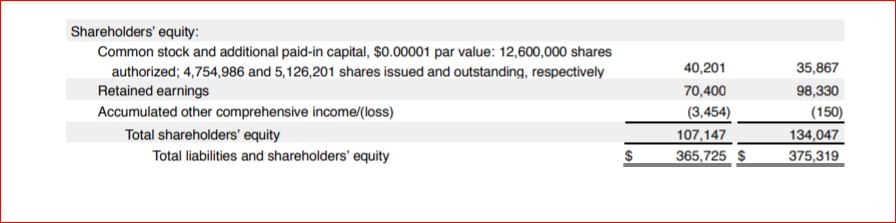

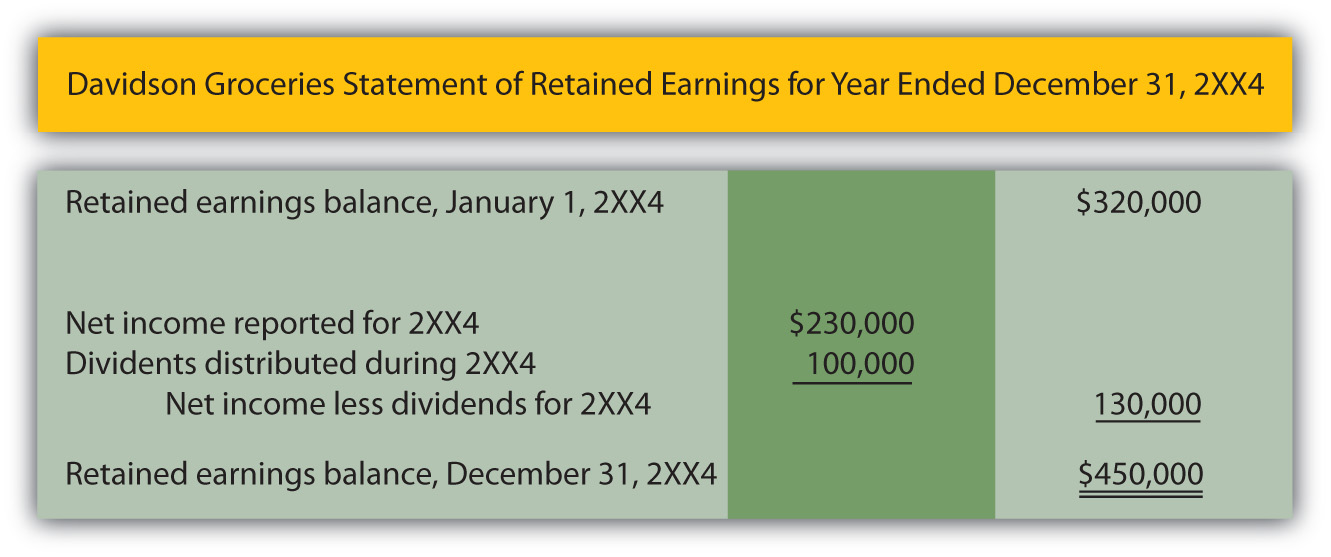

How To Create A Statement Of Retained Earnings For A Financial Presentation

Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. The business owner takes funds out of the business for. Official Site Smart Tools.

These are paid out of after-tax profits. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. To calculate the retained.

2000 in dividends paid out during the period. An owners draw is an amount of money an owner takes out of a business usually by writing a check. Opening Balance Equity This account gets posted to when you create a new chart of account for a.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. Answer 1 of 8.

4000 in net income at the end of the period. Dividends are paid out of the profits and reserves of a company. In other words retained.

It means owners can draw out of profits or retained earnings of a business. The draw method and the salary method. On the other hand drawings can be taken out of the available cash of a business.

Normally this happens in a single. There are two main ways to pay yourself. There are two journal entries for Owners Drawing account.

How do you close out owners draw to Retained Earnings. Salary method vs. Statement of equity and.

Beginning RE of 5000 when the reporting period started. Owners draws can be scheduled at regular intervals or taken only. A draw lowers the owners equity in the business.

Beginning RE of 5000 when the reporting period started. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. It otherwise gets its data from earnings on the profit and loss report.

Owners Drawings are any withdrawals by the owners from the business either in the form of goods services or cash for their personal use. Kryppla 7 yr. The draw decreases the owners capital record and owners equity so now the equation will be.

Owners Equity 400 Assets 1200 Liabilities 800. The Purpose of Retained Earnings. An owner of a sole.

With the draw method you can draw money from your. A summary report called a statement of retained earnings is also maintained outlining the changes in RE for a specific period.

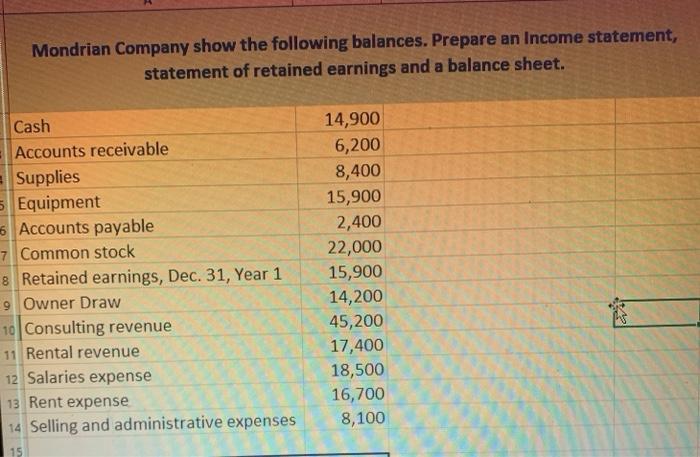

Solved Mondrian Company Show The Following Balances Prepare Chegg Com

Temporary Vs Permanent Accounts Differences Examples Video Lesson Transcript Study Com

Quickbooks Online Basics Making Journal Entries Series 3 Lesson 2 Insightfulaccountant Com

Partnership1 Pdf Debits And Credits Equity Finance

Closing Equity Into Retained Earnings In Quickbooks Desktop Youtube

3 3 Increasing The Net Assets Of A Company Financial Accounting

What Are Retained Earnings Guide Formula And Examples

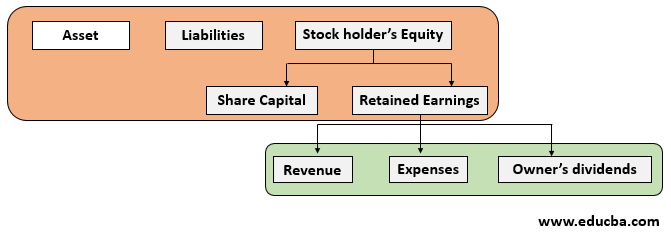

Lo 13 4 Compare And Contrast Owners Equity Versus Retained Earnings V2 Principles Of Accounting Financial Accounting

What Is The Difference Between Owners Draw Retained Earnings Quora

What Are Accumulated Earnings Definition Meaning Example

Lo 13 4 Compare And Contrast Owners Equity Versus Retained Earnings V2 Principles Of Accounting Financial Accounting

3 Ways To Account For Dividends Paid Wikihow

Temporary Account Different Components Of Temporary Accounts

Is Retained Earning An Asset Classification Purpose

Lo 13 4 Compare And Contrast Owners Equity Versus Retained Earnings V2 Principles Of Accounting Financial Accounting

All About The Owners Draw And Distributions Let S Ledger

Abstract Word Cloud For Statement Of Retained Earnings With Related Tags And Terms Canstock

Part 3b Equity Dividends Retained Earnings Ppt Video Online Download

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)